Leadership Catalyst Blog

BRIC Countries Might Fall Short on Their Vision for Economic Growth

All Blog Posts, Business, Change, Human Capital, Strategy / 05.05.2014

In my last post, I summarized a great presentation from Vistage Speaker Herb Meyer about the dramatic global drop in birthrates and the implications for businesses in this country. In this post, I will be summarizing Herb’s comments and will add my own conclusions on the “BRIC” countries (Brazil, Russia, India, and China) that have often been cited as the emerging markets that will drive the global economy.

Brazil –Brazil is a real bright spot amongst the BRICs in that the country has a healthy birthrate of over 2.1, modernization is accelerating, and the middle class is growing by 10 to 20 million people per year. While you need Portuguese speaking resources to do business in Brazil, it is a great market to go after with existing US products and services tailored to the specific market preferences.

Russia – Russia is in trouble with a low birthrate of 1.4 and a rapidly aging population that lacks young people to replace the economic output of the baby boomers. The average Russian woman has had 6 abortions, which further reduces fertility rates. A couple of years ago, one of Russia’s provinces attempted to address the birth rate problem by declaring September 12th as “The Day of Conception” — closing its businesses at noon so workers could go home and “make another patriot” for Russia. A few years later, September 12th was proclaimed a national holiday called “The Day of Marital Contact. ” So far we haven’t seen a big spike in June birthrates. Russia has a lot of wealth coming from the energy sector, but their overall economy is not particularly diverse. Russia does not have a large growing middle class to whom U.S. products and services can be marketed.

India – India is the country to watch out for. India’s birthrate is 2.8 and significant portions of the population are well educated and speak English. Herb thinks India will blow past China in terms of economic growth because the country has a gigantic middle class society and the next generation will be even larger while China’s will be getting smaller.

India is not without problems. India has a terrible power grid, the roads are bad, and other facets of the country’s infrastructure are poor. India (and China) also has a huge gender imbalance because of their culture’s strong preference for boys. Statistically, on a global basis, the ratio of boy babies to girl babies is 1.03. In India and China, with the ability to now determine gender in the womb, that ratio is 1.18. In some provinces it is as high as 1.3. This means is that there are 100 million boys growing up in India and China that will never find wives. Both countries have now made it a crime for an obstetrician to disclose the sex of an unborn child, and they are closing down the sonogram clinics that have proliferated in local strip malls.

These actions have not eradicated the problem in India. Mohammad Hamid Ansari (the former President of India) recently disclosed that since making it a crime to disclose the sex of an unborn child, over 7,000 newborn girls are being murdered by their own parents every day. India has set up a network of refuges where parents can now drop off their newborn daughters rather than killing them in hopes of addressing this problem.

China – What China has done in the last couple of decades to bring its people out of poverty is nothing short of amazing, but the country has hit an economic wall. The value proposition that has driven China’s growth is twofold: China makes things happen and they provide cheap labor.

Before, China could put up a new factory in 6 months whereas in the U.S. it could take 5 years to do an environmental impact statement. China simply relocated the peasants who were in the way. It is more difficult to do that to the educated middle class. The level of unrest and protest in China today is greater than it was in the Soviet Union just before the fall of the Iron Curtain. China can’t make things happen nearly as quickly as they used to.

Cheap labor is also going away. China has had a 1 child per couple policy for decades and consequently its birth rate is at 1.1 and it is the most rapidly aging large country on earth. For the first time in history, the Chinese workforce declined last year, and scarcer labor is dramatically increasing labor costs. American countries are taking their manufacturing to cheaper labor sources such as South Vietnam, Bangladesh, and Burma, or even bringing it back to the US.

Affluent Chinese are starting to buy up real estate from Seattle to San Diego as a place to go if the situation in China deteriorates beyond their comfort. Herb feels another part of China’s contingency plan is to send their kids to American schools so that if they need to leave China, they can come into the US under their kids’ student visas. This partially accounts for the large increase in Chinese students in American universities and even high schools.

In China, the gender gap because of the cultural preference for boys is expected to be about 200 million men by 2015. An entire industry is springing up to take planeloads of Chinese men to Ho Chi Min City, Rangoon and other Asian cities to meet potential wives. Aging parents are driving this trend because in most Asian cultures, it is the daughters and daughter-in-laws who look after the elderly. In China there are 165 million elderly people with no pensions, no health insurance and no daughters. By 2025 there will be 250 million old people in China. This is why China is changing the one child per family law, but it will take decades to see a difference. China, in Herb’s opinion, will not be taking over the world.

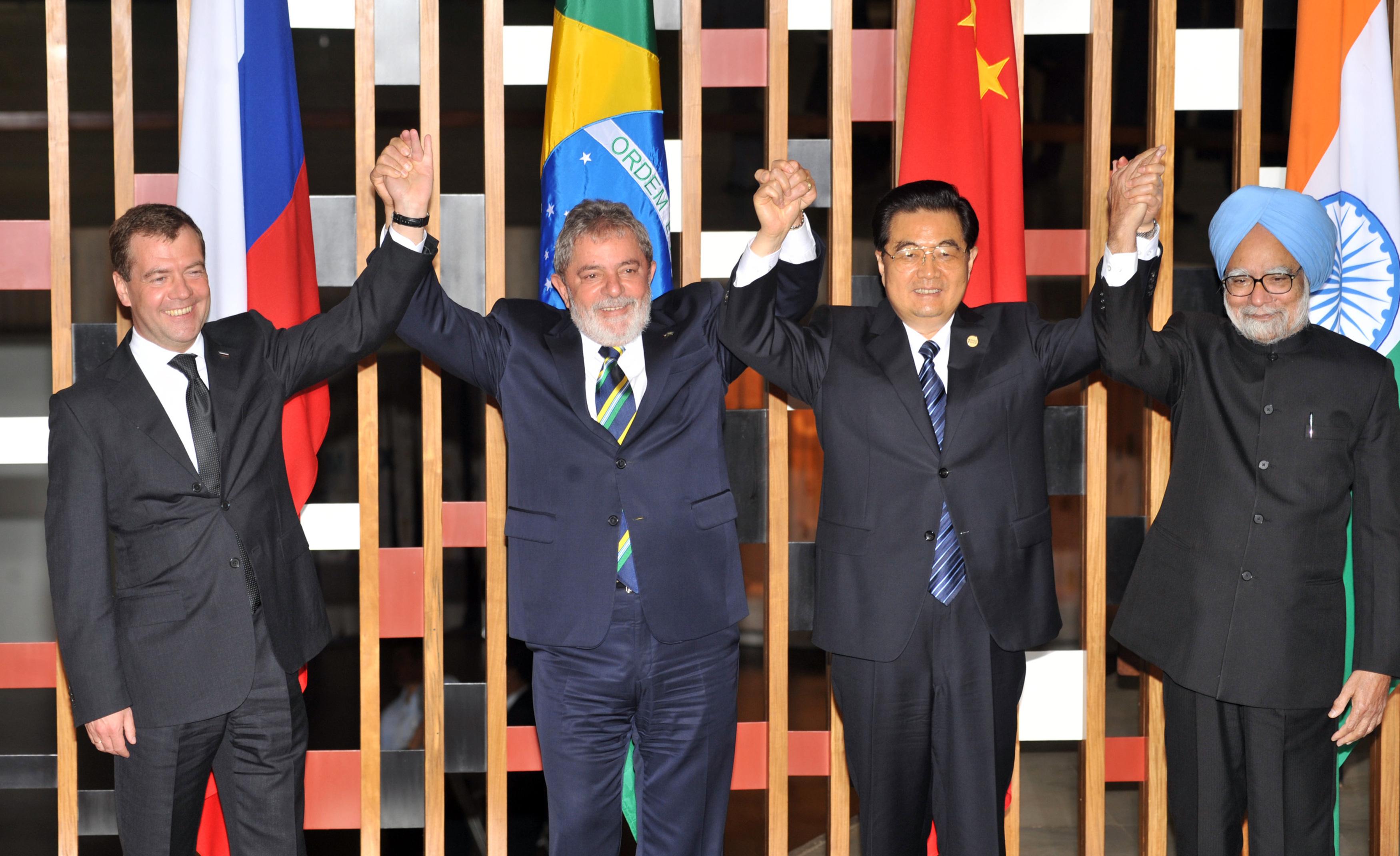

2010 BRIC Summit – The global excitement about the BRIC economic growth potential has faded since the summit.

Bottom line: Brazil and India, with their healthy birthrates and burgeoning middle class populations, will be fantastic markets for American products for decades to come. Continue to market to China’s enormous middle class, but recognize that it will be shrinking. Demand for products and services to accommodate the needs of its rapidly aging population will be exploding, if they can find a way to pay for it. Russia does not appear to be a great new market for American countries given its low birth rate and rapidly aging population.

Many thanks to Herb Meyer for sharing his knowledge with my Minnesota Vistage Groups. Herb’s opinions are based on statistics from the World Health Organization and backed by a decorated career within the US Intelligence community. I believe they are very relevant to any company considering doing business in BRIC countries.

Read More >>Some economic humor…And some serious Vistage economic predictions

All Blog Posts, Vistage Peer Groups / 13.03.2012

As election year heats up, we keep hearing conflicting reports about the labor market’s gains from the economic recovery. At times, the arguments are reminiscent of the “Who’s on First” routine that Abbot and Costello were so famous for. Here is some of that same logic to help us understand how the number of people without jobs is going up while the unemployment rate is going down.

As election year heats up, we keep hearing conflicting reports about the labor market’s gains from the economic recovery. At times, the arguments are reminiscent of the “Who’s on First” routine that Abbot and Costello were so famous for. Here is some of that same logic to help us understand how the number of people without jobs is going up while the unemployment rate is going down.

COSTELLO: I want to talk about the unemployment rate in America.

ABBOTT: Good Subject. Terrible times. It’s 9%.

COSTELLO: That many people are out of work?

ABBOTT: No, that’s 16%.

COSTELLO: You just said 9%.

ABBOTT: 9% Unemployed.

COSTELLO: Right 9% out of work.

ABBOTT: No, that’s 16%.

COSTELLO: Okay, so it’s 16% unemployed.

ABBOTT: No, that’s 9%…

COSTELLO: Wait a minute. Is it 9% or 16%?

ABBOTT: 9% are unemployed. 16% are out of work.

COSTELLO: If you are out of work, you are unemployed.

ABBOTT: No, you can’t count the “Out of Work” as the unemployed. You

have to look for work to be unemployed.

COSTELLO: BUT THEY ARE OUT OF WORK!

ABBOTT: No, you miss my point.

COSTELLO: What point?

ABBOTT: Someone who doesn’t look for work, can’t be counted with

those who look for work. It wouldn’t be fair.

COSTELLO: To whom?

ABBOTT: The unemployed.

COSTELLO: But they are ALL out of work.

ABBOTT: No, the unemployed are actively looking for work. Those who

are out of work stopped looking. They gave up. And, if you give up,

you are no longer in the ranks of the unemployed.

COSTELLO: So if you’re off the unemployment rolls, that would count

as less unemployment?

ABBOTT: Unemployment would go down. Absolutely!

COSTELLO: The unemployment just goes down because you don’t look for work?

ABBOTT: Absolutely it goes down. That’s how you get to 9%.

Otherwise it would be 16%. You don’t want to read about 16%

unemployment do ya?

COSTELLO: That would be frightening.

ABBOTT: Absolutely.

COSTELLO: Wait, I got a question for you. That means they’re two

ways to bring down the unemployment number?

ABBOTT: Two ways is correct.

COSTELLO: Unemployment can go down if someone gets a job?

ABBOTT: Correct.

COSTELLO: And unemployment can also go down if you stop looking for a job?

ABBOTT: Bingo.

COSTELLO: So there are two ways to bring unemployment down, and the

easier of the two is to just stop looking for work.

ABBOTT: Now you’re thinking like an economist.

COSTELLO: I don’t even know what I just said!

And now you know why unemployment figures are improving!

For a more serious treatment of the issue, watch this 8 minute video by Brian Westbury, chief economist at First Trust.

[youtube=http://www.youtube.com/watch?v=fS_LpEs-4Uo&w=480&h=360]

Brian points out that over the last several decades, the official unemployment rate, (currently 8.3 %) is almost perfectly correlated with the jobless rate (aka The U-6 Index) which is currently 15%. Mathematically, the U-6 index is consistently 1.8 times the official unemployment number, and since that ratio has not changed, the gap between the two is not increasing because more people have simply stopped looking for a job. He does suggest that the gap may widen with the aging of our population as the percentage of people over age 60 who want to remain increases.

While we can debate how to best measure unemployment, a couple of facts are evident:

1. The U.S. added more than 200,000 jobs for the third consecutive month. (WSJ – 3/10/2012)

2. This job growth was predicted by the Vistage Q4 2011 CEO Confidence Index at the end of last year. Here is a quick summary of those results.

2. This job growth was predicted by the Vistage Q4 2011 CEO Confidence Index at the end of last year. Here is a quick summary of those results.

Vistage members were not only more optimistic about prospects for the national economy, but also about the outlook for their own firm’s performance during the year ahead. The Vistage CEO Confidence Index was 98.8 in the fourth quarter 2011 survey, up from 83.5 in the third quarter and reaching the highest level since the start of 2011 (105.2).

Below are some key highlights from the Q4 Vistage CEO Confidence Index:

- 41% of CEOs recognized improved economic conditions over the previous 12 months, up from just 18% in the Q3 survey.

- Only 12% of CEOs thought the economy had recently worsened.

- 73% of CEOs expected revenue growth.

- 55% of CEOs said they plan to increase the number of their employees over the next 12 months, compared with 46% in the Q3 survey.

- 43% of CEOs said the European debt crisis impacts their business.

- 24% of CEOs are finding it easier to obtain credit for their business today compared to 6 months ago.

- 49% of CEOs believe Mitt Romney will emerge as the Republican Presidential Nominee for 2012, while 29% believe it will be Newt Gingrich.

The Vistage CEO index has become a very reliable and accurate predictor for the economy and job growth 2 quarters out. Having these insights into the future provides a competitive advantage to Vistage member companies, and is one of the many reasons that they consistently outperform their non-member peers.

The Q1 2012 CEO confidence index is currently being compiled, and I will post an update in early April

Read More >>