Leadership Catalyst Blog

New Ammunition in the Twin Cities War for Talent

All Blog Posts, Talent Acquisition, Talent Management / 10.03.2015

For decades recruiters have known that it is really hard to get people to move to the twin cities but that once they do it’s impossible to get them to leave. An article in the March 2015 issue of the Atlantic entitled “The Miracle of Minneapolis” penned by Derek Thompson highlights a compelling economic reason behind this adage: no other city mixes affordability, opportunity, and wealth so well.

Minneapolis – St. Paul was one of only three major metro areas to be on two top 10 economic lists that recently came out. The first is a Trulia study that looked at homeowners’ monthly payments in each city relative to the areas median income. The second a Harvard-Berkeley study examining which cities have the highest intergenerational mobility. Many metropolitan areas seem to have caused a trap for their younger residents in which they cannot afford housing and find a job that positions them well for the future. The Twin Cities seems to have realized both affordable housing and upward job mobility.

Other top ten lists that the Twin Cities makes such as the most bike friendly city, Money’s best place to live, and most fit city are just icing on the cake. The fact that young families can come here for great careers and affordable housing is very compelling value proposition for millennials and this article is a great arrow in your quiver for attracting top talent.

How has the Twin Cities done this and continued to make its mark as a strong business friendly region? According to Thompson, “The Twin Cities’ housing and tax-sharing policies have resulted in lots of good neighborhoods with good schools that are affordable for young graduates and remain nice to live in even as their paychecks rise. This, in turn, has nurtured a deep bench of 30- and 40-something managers, who support the growth of large companies, and whose taxes flow to poorer neighborhoods, where families have relatively good odds of moving into the middle class.”

A fact often touted in the region is that the Twin Cities has more Fortune 500 companies per capita than any other metropolitan area. One strong reason for this is the deep blend of 30 and 40 something talented middle managers that help build and grow those companies.

As you recruit out of state talent for your business, let them know that the Twin Cities, along with your company, is a place that grows, fosters and retains talent like no place else.

Read More >>

Schwing USA charges back – 10 Lessons for leveraging Chapter 11

All Blog Posts, Change, Strategy / 19.03.2014

A hallmark of an effective CEO Peer Group is having members with a diverse set of experiences. A CEO mix featuring a variety of industries, company sizes, and life cycle maturity stages creates a brilliant wealth of knowledge that members can draw on to assist in whatever challenges they are currently facing. As some Vistage members have quipped, it’s nice to have the opportunity to learn from someone else’s mistakes rather than to make them all yourself.

My Minneapolis Vistage groups include several Fast50 members, a Power50 member, the 2013 Manufacturer of the Year and a perennial “Best Place to Work” winner. CEOs are going to have a lot of ups and downs in their careers just like anyone else, and CEOs need a forumthat can help us through the bad times as well as the good. Our CEO Advisory Board is fortunate to include Brian Hazeltine, CEO of Schwing America, who was featured last month on the cover of Enterprise Minnesota for leading his company back from the brink of financial ruin.

Read Schwing Ahead in the February issue of Enterprise Minnesota® magazine.

As Lynn Shelton, Enterprise Minnesota’s Director of Marketing & Communications, writes in their February 21,2014 e-Trends newsletter:

“In September 2009, just two weeks after taking over as CEO, Hazelton brought the company into Chapter 11 bankruptcy protection, just one more move in what our profile called “an almost surreal litany of recession-related poor timing and bad luck that forced the nation’s leading manufacturer of concrete pumps to spend more than four years in a corporate bob and weave,” waiting for the housing industry to bounce back.”

During the housing boom ten years ago Schwing was racing to keep up with demand. At its peak, Schwing grew to 680 employees and ran its 400,000 square-foot facility in White Bear Township 24/7. When the construction industry bottomed out, Schwing had to lay off close to 600 employees and close its in-house paint operation, welding shop and fabrication facility. The story of how Hazelton and his team nimbly managed through, creatively leveraging the Schwing brand and keeping close to its customers (who were also enduring a difficult time) is an inspiration.

Here are few key lessons Brian Hazelton of my Minnesota Vistage group can teach us about surviving a “perfect storm” and repositioning his company to thrive and double next year.

1) Believe in your product strongly enough to fight for it even when the universe seems to be turning against you

2) Beware of unrelated but compounding converging trends

3) When there is a will there is a way – the drive to survive can move mountains

4) Be willing to take on multiple jobs when times are tough

5) Don’t be afraid to reinvent yourself

6) While Chapter 11 is nobody’s first choice, it can be the best strategic option when you are not left with many paths forward

7) Don’t forget about your customers even when they aren’t buying

8) Help your customers sell your product

9) If you don’t tell your story when times are tough, somebody else will and odds are you won’t like their version as well

10) Paying it forward can bring about payback – loyalty is a form of Karma

Read More >>

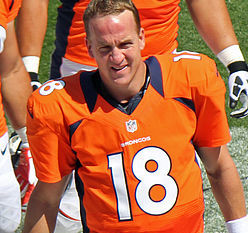

Lessons in Leadership Legacies via Peyton Manning and Shaun White

Motivation, Vistage Peer Groups / 13.02.2014

Many of us were disappointed in the quality of the 2014 Super Bowl Game, but undoubtedly none more so than Bronco’s quarterback Peyton Manning. Common sense says it’s not fair to judge a career by one event, but popular culture seems programmed to only remember the big wins and losses. The real legacy can get lost; namely the often invisible influence and impact one’s action and character had on others throughout the career.

A fan who understands what legacy is really all about out reached out to Manning through a letter in the Denver Post. Laurie Lattimore-Volkmann shares, why Manning’s legacy was secure well before Sunday’s game. Click here for the one page letter written from the perspective of a mother and a life-long Broncos fan.

Shaun White won back to back half pipe snowboarding gold medals in the Torino and Vancouver Olympics and he was the favorite coming into yesterday’s finals in Sochi. White ended up finishing just off the podium in 4th place, but he was gracious as ever in congratulating the winner. Kare11 just ran a neat story that illustrates the profound impact that Shaun White has had on a local Twin Cities boy. White’s 4th place finish in Sochi will make him no less of a hero in Jet’s eyes.

Take a moment to reflect on your legacy as a leader in your company. What would your people say about you? What one thing would you like to change starting today?

Read More >>

5 Questions to Ask to Avoid Being the Bullseye of a Data Breach

Business, Vistage Peer Groups / 11.02.2014

The hacking of 40 Million Target Shoppers over the holidays is still an unfolding travesty and other retailers like Neiman Marcus and others have likewise been affected. It’s bad enough when hackers target your system directly, but it now appears that Target was compromised by the lack of security at its VENDORS; the very people with the largest stake in Target’s success were the unwitting pathway for the criminals who stole so much personal data!

To Target’s dismay, the news broke on Friday that the vendor in question was not a giant merchandise supplier, but a small 125 person mechanical contracting firm in Pittsburgh, PA that had done some work for several Target stores. Hackers targeted the vendor’s system and its connection to Target’s vendor management system in order to gain access.

If you’re a C-Level decision maker, the blame for a vendor security breach will find its way to your desk as Gregg Steinhafel, the CEO of Target, is experiencing now. I would highly recommend taking a few minutes to read a summary of the Target breach by Vistage Speaker Mike Foster who advises Vistage CEOs across the US on how to understand and manage risky information technology aspects of their businesses. His advice may be even more critical for my Minnesota Vistage CEOs, Owner and Executive members, who have major contracts with high profile Fortune 500 companies.

In a recent blog post, Foster highlights 5 key questions that you should be asking your IT Staff to ensure that you understand how your business is protected. Proactively asking these questions now will increase the odds that you won’t have to face angry customers asking you the same questions after it is too late.

In a recent blog post, Foster highlights 5 key questions that you should be asking your IT Staff to ensure that you understand how your business is protected. Proactively asking these questions now will increase the odds that you won’t have to face angry customers asking you the same questions after it is too late.

CEOs – Quit While You Are Ahead?

Change, Vistage Peer Groups / 07.01.2014

Long tenure is often perceived as a measure of success and a sign of CEO competence. But does the data bear this out? Not according to this INC. Magazine article “CEOs: Why You Should Quit While You’re Ahead” which offers some insightful findings about CEO tenure. The study focuses primarily on large companies but even in small to midsize privately held companies, can the CEO stay too long?

Several experts maintain that the CEO is on a steep learning curve during the first couple of years but will really hit his or her stride in years 3-5. After 5 years, however, the company’s results begin to decline. According to Michael Jarret at INSEAD, “The team’s research found that when a CEO stays over five years, customer relationships, product safety and quality, and financial returns will all decline.”

One reason for the decline is that you are more likely to settle for the status quo. “After the initial rush of enthusiasm and energy, established routines and networks can smother the drive for innovation,” Jarrett writes. A second reason for the decline is that you stop learning. “… as CEOs accumulate knowledge and become entrenched, they rely more on their internal networks for information, growing less attuned to market conditions,” the authors say.

One way to avoid this decline is suggested in the title of the article: CEOs: Why you should quit while you’re ahead. In certain situations a CEO choosing to step down may very well be the wise or heroic thing to do. On the other hand, installing a new CEO every 5 years is not practical for many companies, especially small and medium size businesses. And why would someone who has persevered through many challenges and worked hard to rise to the top leadership role want to quit?

Quitting your job as CEO will certainly bring about change for your company (for better or worse). Another path forward is to join a CEO Peer Advisory Board of independent CEOs who will continually challenge your thinking, push you out of your comfort zone, and keep you externally focused and learning.

Read More >>

3 Things You Need to Know About Vistage CEO Peer Groups

All Blog Posts, Vistage Peer Groups / 03.12.2013

Vistage CEO Peer Groups are a powerful resource for Minnesota business leaders.

As the leading Vistage Chair in the Twin Cities, I routinely facilitate peer groups for some of the top executives in Minnesota. Over the last year, my peer groups have been noted in a variety of publications such as The Minneapolis Star Tribune, The Minneapolis/St. Paul Business Journal, and Entrepreneur Magazine.

Despite increasing amounts of media coverage, many business leaders are still unaware of the benefits that CEO peer groups have to offer. The most frequently asked questions I encounter are:

- What is a CEO or executive peer group?

- Why do people join CEO peer groups?

- What topics do CEO peer groups cover?

The following post provides answers to those questions and guidance on finding the right peer group for you.

1) What is a CEO peer group?

A CEO peer group is a cohort of executives and owners of non-competing businesses who meet regularly to help each other grow their organizations, their people, and themselves.

These peer groups are intended to be a confidential “safe haven” where business leaders can work through their toughest strategy, leadership, and people challenges together.

Most importantly, CEO peer groups consist of experienced executives who share the frank feedback that is often so hard to obtain within one’s organization.

2) Why do people join CEO peer groups?

The members of my CEO peer groups join for a variety of reasons, both personal and professional.

Most entrepreneurs join CEO peer groups because they want to increase their effectiveness as leaders or enrich their lives – for entrepreneurs these aims are often intertwined.

For CEOs or heads of companies, many join CEO peer groups because they want to run their businesses instead of having their businesses run them. These individuals find that meeting monthly with a group of experienced, non-judgmental peers helps stop them from working “in the business” so they can focus on working “on the business” by being more strategic.

3) What topics are covered in CEO peer groups?

Vistage CEO peer groups tackle the most difficult challenges that executives face.

The topics covered in my CEO peer groups include business strategy shifts, assessing talent, and work-life balance. Often CEOs find that posing a challenge to a peer groups helps them clarify the real issue and frame their problem more accurately.

Here are some examples of issues we processed recently:

Merger Matchmaking

The CEO of $70M company was behind his revenue plan and wanted help analyzing a potential merger opportunity with a much smaller firm before taking it to his board of directors.

The group asked him a number of tough questions about the strategic fit of the target company to assure he had covered his bases before taking it to the board.

Strategic Focus

A $2M family firm felt that their sales had plateaued, and the CEO was trying to decide whether he had the right people in the sales role. Further probing by the group revealed that his sales people had been highly successful in the past, and that there were plenty of opportunities in the pipeline.

The group discussion led to the insight that sales people were spending a lot of time on opportunities that were outside of the company’s sweet spot. The group helped him better define his target customer so he could focus his sales effort there, rather than chasing opportunities that were outside of their core.

Finally, they suggested that he and his sales people go on a few joint calls to make sure they were executing good sales fundamentals, and had not developed bad habits.

Trust Issues

A relatively new CEO who had been brought in from the outside felt a need to either get an executive coach for a key member on her leadership team, who she didn’t trust. The group asked her a number of questions to help her diagnose whether the trust issues she was experiencing were a function of the person’s “character” or “capability.”

They shared their experiences with executive coaching, and suggested that while it can be highly effective in closing capability gaps, it doesn’t work when the trust issues are due to character or integrity gaps. Based on their input, she decided that she and the organization would be better off if she replaced the key executive.

Joining Executive Peer Groups

Overcome your business challenges by joining a Vistage CEO peer group.

Peer advisory groups are an important staple of the Vistage experience. My peer groups are a place for Twin Cities executives can hash out their most difficult business problems in a confidential setting.

Vistage groups have leaders from small to large companies across a range of industries, including manufacturing, finance and technology. Although Vistage members are typically accepted by referral, interested individuals can familiarize themselves with my Vistage groups to determine whether they are a good fit.

Read More >>

Business failure isn’t a sudden event.

Minnesota business leaders need to focus on accurate performance indicators to ensure long-term success.

Florida: December 29th, 1972

Eastern Airlines Flight 401 was a routine flight traveling from JFK Airport to Miami. As the pilots engaged the landing gear they noticed that one of the plane’s three indicator lights failed to turn on.

Not knowing whether the light was burned out or whether the landing gear had failed to lock in place, the two pilots and flight engineer focused on solving the problem.

They tried unsuccessfully to reengage the landing gear and then sent the flight engineer down below to see if he could do a visual check from a small window in the plane’s nose.

The three were so focused on fixing the problem that they failed to notice that one of them had nudged the plane’s control column with his knee, which disengaged the autopilot and sent the plane into an “imperceptible descent.”

The pilots had taken their eye off the plane’s dashboard, which had several indicators to show they were losing altitude and were in peril.

At 11:42 p.m. Flight 401 slammed into the everglades at 244 mph, killing 101 people.

How Minnesota business executives can avoid imperceptible descent

The crash of Flight 401 is not simply a tale of a blundering flight crew. The majority of business crises arise due to a similar misplacement of focus at the executive level that causes a company to slip into a disastrous imperceptible descent.

Business speaker Mike Richardson (Author of Wheelspin) recently led a discussion on imperceptible descent at my Vistage CEO Peer Advisory Group meetings, and impressed upon us the importance of keeping our eyes on the horizon and key business indicators.

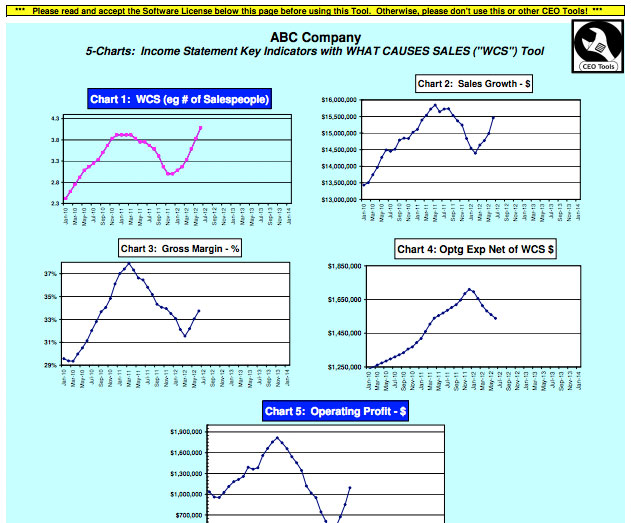

In our next meeting, Vistage speaker Kraig Kramers made a compelling case that the monthly and year-to-date financial reports that most companies rely on do not give an accurate picture of what is truly happening in a business.

Financial reports typically do not control for varying month lengths and how weekends or holidays fall in a given year. This means that there could be 20% more business days from one February to the next, making for an inaccurate comparison.

The solution is to replace the typical monthly financial spreadsheets with trailing twelve month charts which plot the moving 12 month totals or averages for your key indicators.

These eliminate the “noise” caused by random monthly variation and give you a true picture of what is happening in your business (up is good, down is bad).

What business performance measures are important?

Key performance measures for a business will vary by industry. Kraig Kramers recommends starting with five fundamental measures that apply to all businesses:

- What causes sales (WCS)

- Sales growth

- Gross margin

- Operating expense net of WCS

- Operating profit

Chart these measures on a single page to get a true picture of whether your business is experiencing an imperceptible decline.

The task may appear daunting initially, but the good news is that business leaders do not have to reinvent the wheel – a spreadsheet version of this chart is available online.

The spreadsheet that Kraig provides also includes several tips to ensure that you get the most value out of it.

The members of my Vistage Peer Advisory Group have found these performance measures helpful in recalibrating how they evaluate the performance of their companies.

Brian L. Davis is the leading Vistage Chair in the Twin Cities. Learn more about his Vistage member companies here.

Read More >>“Change is Good, You Go First”

All Blog Posts, Change / 01.05.2013

“Change is Good, You Go First…so goes an old Dilbert Cartoon. So, just how do we “go first?” The essence of being a manager has been eloquently summed up by Former Porsche CEO and longtime Vistage Speaker Peter Schutz who reminds the Vistage groups he visits that “Managers are unnecessary, until something changes.” Things can always be counted on to change but people seem genetically programmed to resist doing anything about it; including CEOs who have a tendency to be human themselves.

What do we do about it? Another Vistage Speaker, Andrea Simon, examines Why We’re so Afraid of Change, in a recent Forbes article. She offers some handy tips and practical tools that CEOs and Senior Executives can use to get everyone on offense instead of defense. If you want the organization to change, you need to start with yourself. Don’t just demand that your people come up with new ideas—broaden your perspective by getting out of your box—a.k.a. your office. Since a lot of innovation comes from outside your industry, don’t just go to your industry trade show, go to other industry trade shows. Or join a CEO Peer Group with successful executives from multiple industries.

Another idea is to visit not only your current customers, but people who you would like to have as your customer. Leverage your CEO title to meet with CEOs and other senior leader’s in those companies. One of my most successful Vistage group members totally transformed her business by having several meetings with big potential customers to ask them about their unmet needs and problems that they were having with all of their suppliers that if changed, would transform their business. She listened and dramatically changed the way they do business, which in three years transformed them from being at the bottom of the pack to the leading supplier of her type in her market.

“Going first” when it comes to managing change is one of your most important jobs as a CEO.

Read More >>