Leadership Catalyst Blog

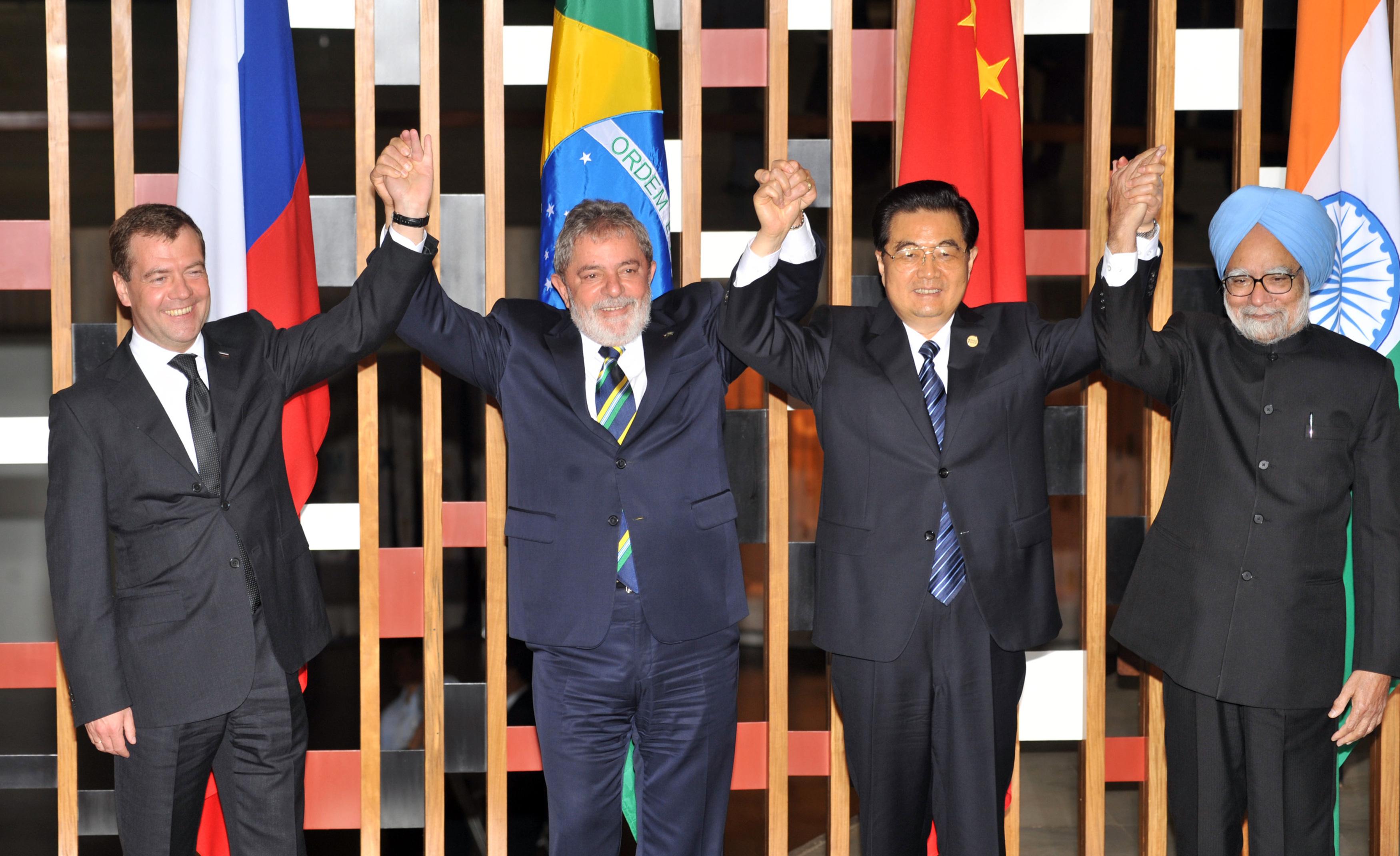

BRIC Countries Might Fall Short on Their Vision for Economic Growth

All Blog Posts, Business, Change, Human Capital, Strategy / 05.05.2014

In my last post, I summarized a great presentation from Vistage Speaker Herb Meyer about the dramatic global drop in birthrates and the implications for businesses in this country. In this post, I will be summarizing Herb’s comments and will add my own conclusions on the “BRIC” countries (Brazil, Russia, India, and China) that have often been cited as the emerging markets that will drive the global economy.

Brazil –Brazil is a real bright spot amongst the BRICs in that the country has a healthy birthrate of over 2.1, modernization is accelerating, and the middle class is growing by 10 to 20 million people per year. While you need Portuguese speaking resources to do business in Brazil, it is a great market to go after with existing US products and services tailored to the specific market preferences.

Russia – Russia is in trouble with a low birthrate of 1.4 and a rapidly aging population that lacks young people to replace the economic output of the baby boomers. The average Russian woman has had 6 abortions, which further reduces fertility rates. A couple of years ago, one of Russia’s provinces attempted to address the birth rate problem by declaring September 12th as “The Day of Conception” — closing its businesses at noon so workers could go home and “make another patriot” for Russia. A few years later, September 12th was proclaimed a national holiday called “The Day of Marital Contact. ” So far we haven’t seen a big spike in June birthrates. Russia has a lot of wealth coming from the energy sector, but their overall economy is not particularly diverse. Russia does not have a large growing middle class to whom U.S. products and services can be marketed.

India – India is the country to watch out for. India’s birthrate is 2.8 and significant portions of the population are well educated and speak English. Herb thinks India will blow past China in terms of economic growth because the country has a gigantic middle class society and the next generation will be even larger while China’s will be getting smaller.

India is not without problems. India has a terrible power grid, the roads are bad, and other facets of the country’s infrastructure are poor. India (and China) also has a huge gender imbalance because of their culture’s strong preference for boys. Statistically, on a global basis, the ratio of boy babies to girl babies is 1.03. In India and China, with the ability to now determine gender in the womb, that ratio is 1.18. In some provinces it is as high as 1.3. This means is that there are 100 million boys growing up in India and China that will never find wives. Both countries have now made it a crime for an obstetrician to disclose the sex of an unborn child, and they are closing down the sonogram clinics that have proliferated in local strip malls.

These actions have not eradicated the problem in India. Mohammad Hamid Ansari (the former President of India) recently disclosed that since making it a crime to disclose the sex of an unborn child, over 7,000 newborn girls are being murdered by their own parents every day. India has set up a network of refuges where parents can now drop off their newborn daughters rather than killing them in hopes of addressing this problem.

China – What China has done in the last couple of decades to bring its people out of poverty is nothing short of amazing, but the country has hit an economic wall. The value proposition that has driven China’s growth is twofold: China makes things happen and they provide cheap labor.

Before, China could put up a new factory in 6 months whereas in the U.S. it could take 5 years to do an environmental impact statement. China simply relocated the peasants who were in the way. It is more difficult to do that to the educated middle class. The level of unrest and protest in China today is greater than it was in the Soviet Union just before the fall of the Iron Curtain. China can’t make things happen nearly as quickly as they used to.

Cheap labor is also going away. China has had a 1 child per couple policy for decades and consequently its birth rate is at 1.1 and it is the most rapidly aging large country on earth. For the first time in history, the Chinese workforce declined last year, and scarcer labor is dramatically increasing labor costs. American countries are taking their manufacturing to cheaper labor sources such as South Vietnam, Bangladesh, and Burma, or even bringing it back to the US.

Affluent Chinese are starting to buy up real estate from Seattle to San Diego as a place to go if the situation in China deteriorates beyond their comfort. Herb feels another part of China’s contingency plan is to send their kids to American schools so that if they need to leave China, they can come into the US under their kids’ student visas. This partially accounts for the large increase in Chinese students in American universities and even high schools.

In China, the gender gap because of the cultural preference for boys is expected to be about 200 million men by 2015. An entire industry is springing up to take planeloads of Chinese men to Ho Chi Min City, Rangoon and other Asian cities to meet potential wives. Aging parents are driving this trend because in most Asian cultures, it is the daughters and daughter-in-laws who look after the elderly. In China there are 165 million elderly people with no pensions, no health insurance and no daughters. By 2025 there will be 250 million old people in China. This is why China is changing the one child per family law, but it will take decades to see a difference. China, in Herb’s opinion, will not be taking over the world.

2010 BRIC Summit – The global excitement about the BRIC economic growth potential has faded since the summit.

Bottom line: Brazil and India, with their healthy birthrates and burgeoning middle class populations, will be fantastic markets for American products for decades to come. Continue to market to China’s enormous middle class, but recognize that it will be shrinking. Demand for products and services to accommodate the needs of its rapidly aging population will be exploding, if they can find a way to pay for it. Russia does not appear to be a great new market for American countries given its low birth rate and rapidly aging population.

Many thanks to Herb Meyer for sharing his knowledge with my Minnesota Vistage Groups. Herb’s opinions are based on statistics from the World Health Organization and backed by a decorated career within the US Intelligence community. I believe they are very relevant to any company considering doing business in BRIC countries.

Read More >>

Global Macro Economic Trends that will Impact your Twin Cities Business

All Blog Posts, Business, Change, Strategy / 02.04.2014

Vistage Chairs bring in a wide range of experts to address our CEO and Executive Peer Groups in Minneapolis every month. Our goal as Vistage Chairs is to increase the effectiveness of CEOs, and one way we do this is by bringing in a speaker on a very specific topic such as how to attract and hire top talent. We will also, bring in speakers who will help our Vistage members take a longer, big picture view of their businesses. In these instances, we encourage executives to look up and scan the radar for what they will be facing in the years to come in addition to focusing on the short-term turbulence they are experiencing.

Herb Meyer, the former senior CIA executive in the Reagan Administration was one such speaker. Since leaving The Agency, Herb has applied his intelligence gathering skills to collecting important data on economic, social, political, and population trends that will dramatically impact our businesses.

Herb presented three megatrends to watch out for and their implications for growing your business.

1. The world is becoming modernized. Technology is sweeping the planet at an amazing rate. Cell phones, the internet, social media, TV, and satellites are connecting people to what is happening throughout the world. Young people throughout the world now have cell phones, and Ipads and can download books, movies, TV shows, and on-line courses from anywhere. Agricultural breakthroughs mean that for the first time in world history, very few people are starving in the “Modern World”, and a major problem for poor people in these countries is obesity.

2. The world is becoming rich. Not only are Millionaires multiplying all over the globe, 50 – 100 million people are coming out of poverty every year. (Non-poverty is defined as having enough to eat, children being inoculated, at least 1 parent working, and having some disposable income.) This means the creation of a large middle class, with 50 – 100 million new customers every year who want the modern conveniences they see on TV and online. The emerging middle class may not be located where we would like them to be, so our challenge is to innovate clever, inexpensive, and green products to serve them.

3. The modern world is becoming old. Populations throughout the world are aging at an alarming rate at the same time as birth rates are plunging. Let’s look at the statistics:

A birthrate of 2.1 births per female is needed to sustain a population, and when birthrates dip consistently below 1.3, a population is on a suicide trajectory. In Europe, the average birthrate is 1.5, and the modern countries that are aging the fastest are Germany, Italy and Spain, all of which have birthrates at or below the 1.3 threshold. In Germany, 30% of all women and 40% of all college educated women are childless. If nothing changes, by 2040, 61% of their population will be over the age of 55. In Italy and Spain the birthrate is at 1.2 and heading for 1.1, and in 20 years they will lose 20% of their workforce. The story is the same in many Asian countries, including Japan, China, and Singapore. In Japan the birthrate is also 1.3, but the population is aging faster. In 20 years, 1 of 5 of their people will be over 70 years old, and in 30 years, the Japanese population will shrink by 60-70 million.. The population is literally dying out, and the people will not tolerate immigration to replace their young people.

In North America, the U.S birthrate is 2.1, (the Anglo birth rate is 1.8 and the Hispanic birthrate is 3.2) and in Canada the birthrate is at 1.5. Finally the birthrate in Mexico is slowing but it is still a healthy 2.6 – 2.7, which means a huge emerging middle class.

By far, the fastest growing populations are in the Muslim world, where birthrates range from 2.6 to 6.8. Two notable exceptions are Turkey and Iran, where birthrates are plummeting.

The implication is that there is a huge growing market for products and services for an aging population with fewer and fewer young people to support them. In Japan, for the first time in history, adult diapers are outselling baby diapers, and a company has invented a robot for bathing people. In Germany, BMW has built a new plant designed for older workers – brighter lighting, non-slip floors and new tooling that requires less physical strength. In Canada, homes are being retrofitted with colored strips across steps and shower ledges to help the elderly with failing depth perception see them and avoid debilitating falls in the home that often result in broken hips.

One of my Minneapolis Vistage members, who manufacturers high pressure hoses for filling industrial gas and oxygen bottles, is seeing a huge increase in demand in the home oxygen tank market. There is huge growth ahead for businesses that figure out how to better serve the wealthy aging population with their existing and new products and services.

So what are these huge business growth opportunities?

1. Look for better ways to meet the needs of an aging world population with fewer young people to take care of them.

2. Adapt your products and services to meet the needs of the 50 – 100 million new customers in the emerging global middle class through the prism of clever, inexpensive and green.

3. As one billion people cross the poverty line in the next couple of decades, there will be tremendous opportunity in the areas of energy, food (especially protein), infrastructure, education, and entertainment. Coincidentally, these are 6 industries in which the U.S. leads the world.

So what about Brazil, Russia, India, and China? Next week’s post will outline the unique challenges and opportunities facing these countries, and why China and Russia are hitting the wall.

Read More >>

5 Questions to Ask to Avoid Being the Bullseye of a Data Breach

Business, Vistage Peer Groups / 11.02.2014

The hacking of 40 Million Target Shoppers over the holidays is still an unfolding travesty and other retailers like Neiman Marcus and others have likewise been affected. It’s bad enough when hackers target your system directly, but it now appears that Target was compromised by the lack of security at its VENDORS; the very people with the largest stake in Target’s success were the unwitting pathway for the criminals who stole so much personal data!

To Target’s dismay, the news broke on Friday that the vendor in question was not a giant merchandise supplier, but a small 125 person mechanical contracting firm in Pittsburgh, PA that had done some work for several Target stores. Hackers targeted the vendor’s system and its connection to Target’s vendor management system in order to gain access.

If you’re a C-Level decision maker, the blame for a vendor security breach will find its way to your desk as Gregg Steinhafel, the CEO of Target, is experiencing now. I would highly recommend taking a few minutes to read a summary of the Target breach by Vistage Speaker Mike Foster who advises Vistage CEOs across the US on how to understand and manage risky information technology aspects of their businesses. His advice may be even more critical for my Minnesota Vistage CEOs, Owner and Executive members, who have major contracts with high profile Fortune 500 companies.

In a recent blog post, Foster highlights 5 key questions that you should be asking your IT Staff to ensure that you understand how your business is protected. Proactively asking these questions now will increase the odds that you won’t have to face angry customers asking you the same questions after it is too late.

In a recent blog post, Foster highlights 5 key questions that you should be asking your IT Staff to ensure that you understand how your business is protected. Proactively asking these questions now will increase the odds that you won’t have to face angry customers asking you the same questions after it is too late.

Predicting & Overcoming Business Growth Barriers

All Blog Posts, Business, Change, Vistage Peer Groups / 18.11.2013

I recently met with a successful entrepreneur who had grown his company to over $4.5M in revenues in just a few short years. He knew he needed a CEO Peer Advisory Board to help him take his company to the next level, but didn’t see how he could squeeze in a monthly peer group meeting in his already packed agenda.

He found himself starting work at 3:00 am to work on client projects, meeting with up to 10 customers a day, and then doing more project work in the evenings.

Like many business owners of companies with less than $5M in revenues, he was so busy selling, serving customers, and putting out fires, he felt he needed to clone himself before joining a group.

It is often said, “What got you here, won’t get you there,” and nowhere is this truism more evident than when trying to profitably grow your company.

Most entrepreneurs struggle with very predictable barriers as they grow their companies from $1M in revenues to $10M and beyond.

Read More >>

Business failure isn’t a sudden event.

Minnesota business leaders need to focus on accurate performance indicators to ensure long-term success.

Florida: December 29th, 1972

Eastern Airlines Flight 401 was a routine flight traveling from JFK Airport to Miami. As the pilots engaged the landing gear they noticed that one of the plane’s three indicator lights failed to turn on.

Not knowing whether the light was burned out or whether the landing gear had failed to lock in place, the two pilots and flight engineer focused on solving the problem.

They tried unsuccessfully to reengage the landing gear and then sent the flight engineer down below to see if he could do a visual check from a small window in the plane’s nose.

The three were so focused on fixing the problem that they failed to notice that one of them had nudged the plane’s control column with his knee, which disengaged the autopilot and sent the plane into an “imperceptible descent.”

The pilots had taken their eye off the plane’s dashboard, which had several indicators to show they were losing altitude and were in peril.

At 11:42 p.m. Flight 401 slammed into the everglades at 244 mph, killing 101 people.

How Minnesota business executives can avoid imperceptible descent

The crash of Flight 401 is not simply a tale of a blundering flight crew. The majority of business crises arise due to a similar misplacement of focus at the executive level that causes a company to slip into a disastrous imperceptible descent.

Business speaker Mike Richardson (Author of Wheelspin) recently led a discussion on imperceptible descent at my Vistage CEO Peer Advisory Group meetings, and impressed upon us the importance of keeping our eyes on the horizon and key business indicators.

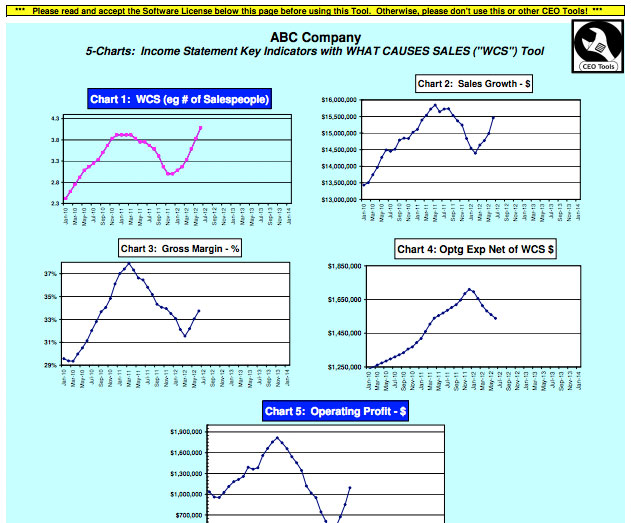

In our next meeting, Vistage speaker Kraig Kramers made a compelling case that the monthly and year-to-date financial reports that most companies rely on do not give an accurate picture of what is truly happening in a business.

Financial reports typically do not control for varying month lengths and how weekends or holidays fall in a given year. This means that there could be 20% more business days from one February to the next, making for an inaccurate comparison.

The solution is to replace the typical monthly financial spreadsheets with trailing twelve month charts which plot the moving 12 month totals or averages for your key indicators.

These eliminate the “noise” caused by random monthly variation and give you a true picture of what is happening in your business (up is good, down is bad).

What business performance measures are important?

Key performance measures for a business will vary by industry. Kraig Kramers recommends starting with five fundamental measures that apply to all businesses:

- What causes sales (WCS)

- Sales growth

- Gross margin

- Operating expense net of WCS

- Operating profit

Chart these measures on a single page to get a true picture of whether your business is experiencing an imperceptible decline.

The task may appear daunting initially, but the good news is that business leaders do not have to reinvent the wheel – a spreadsheet version of this chart is available online.

The spreadsheet that Kraig provides also includes several tips to ensure that you get the most value out of it.

The members of my Vistage Peer Advisory Group have found these performance measures helpful in recalibrating how they evaluate the performance of their companies.

Brian L. Davis is the leading Vistage Chair in the Twin Cities. Learn more about his Vistage member companies here.

Read More >>Is your business model dying? How do you know?

All Blog Posts, Business, Strategy, Vistage Peer Groups / 30.10.2011

- Why did XEROX give the mouse and “windows” technology to APPLE?

- Why didn’t AT&T invent SKYPE?

- Why didn’t MICROSOFT invent GOOGLE?

- Why didn’t BLOCKBUSTER invent NETFLIX?

- What changes have you made to your business model in the last couple of years?

- If an employee came to you with a “game changing” idea that might threaten your core business in the short term, would you listen to them?

- Is your business model dying, how do you know?

Driving Business Results through Employee Engagement

All Blog Posts, Business, Coaching, Motivation, Strategy, Team Building / 08.05.2010

A couple of months ago, I highlighted Daniel Pink’s work on intrinsic motivation in my February 24th blog post entitled “When Traditional Motivation Doesn’t Work”. I concluded that post with the following tips.

♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦ LEADERSHIP CATALYST TIPS ♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦

In several turnaround situations, I have found the key to motivating and engaging employees is to:

- Make them feel valued as people and that they belong

- Help them see how what they do makes a difference, and

- Find a way for them to monitor their own contributions on an ongoing basis.

♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦

- Employee Engagement

I recently stumbled upon a research study which validates these principles, shows how employee engagement and customer loyalty drive financial results, and illustrates how to execute these principles in a grocery store environment. The study was sponsored by the Coca-Cola Retailing Research Council and is entitled “Getting to Great: Mapping Management Practices that Drive Great Store Performance”.

The article is about 30 pages long, but well worth the time, even if you aren’t in the grocery business. Historically, the key to success in store operations has been seen as execution, and “command and control” has been a dominant leadership approach. Seeing how the above principles of employee engagement work in this situation should increase our confidence that they will work in situations involving more ambiguous and complex challenges. Below is a quick recap of their findings.

First, how do we know a great performer when we see one?

- “Great performers are those that overachieve relative to their market potential, not just those with the highest financial results.” Store results are a function not only of the leader’s performance, they are tremendously impacted by the store’s location, customer potential, competitive intensity, and store specific factors. The researchers devised a clever way of controlling for these external factors to show which store managers are executing most effectively against the strategic hand they have been dealt. (pp. 4-6)

- “Great Performers generate intense customer loyalty”.

- “Great performers produce strong employee loyalty and commitment.”

Second, what are the key management practices that great performers use to get these results?

- “Get clarity and commitment to goals. The great performers focused on the one or two most vital goals for improving their store’s performance and put their full focus behind them. By contrast, the more goals there were, the fewer were achieved with excellence.

- Get everyone to focus on the key drivers. Enlist each team member daily to take actions that have the greatest impact on achieving the main goals.

- Implement simple mechanisms to propel goal achievement. Post visible, compelling scorecards in accessible workplace locations.

- Establish a constant cadence of engagement and accountability around the key measures and goals.”

While this is a good recap, go to the report for the specifics of how to measure great performance results and the specific leadership behaviors that lead to it. It is sure to be a catalyst for ideas on how to do the same in your business!

Read More >>Toyota and GM: Getting Bigger at the Expense of Getting Better?

All Blog Posts, Business, Strategy / 05.03.2010

The February 24th edition of Economist Magazine ran an article entitled “The Machine that ran too hot: The woes of Toyota, the world’s biggest car company, are a warning to rivals.” In the article, James Womack, one of the authors of “The Machine that Changed the World”, a book about Toyota’s innovations in manufacturing, dates the origin of its present woes to 2002, when it set itself the goal of raising its global market share from 11% to 15%. Mr. Womack says that the 15% target was “totally irrelevant to any customer” and was “just driven by ego”. In other words,, Toyota got itself in trouble when quality became subordinate to another goal: Selling more cars than GM.

The February 24th edition of Economist Magazine ran an article entitled “The Machine that ran too hot: The woes of Toyota, the world’s biggest car company, are a warning to rivals.” In the article, James Womack, one of the authors of “The Machine that Changed the World”, a book about Toyota’s innovations in manufacturing, dates the origin of its present woes to 2002, when it set itself the goal of raising its global market share from 11% to 15%. Mr. Womack says that the 15% target was “totally irrelevant to any customer” and was “just driven by ego”. In other words,, Toyota got itself in trouble when quality became subordinate to another goal: Selling more cars than GM.

GM apparently is not heeding the warning. WSJ reported on March 3rd “Feeling Heat From Ford, GM Reshuffles Managers“. Ford’s February monthly U.S. sales surpassed GM’s for the first time in 50 years. Hours after the sales results were released, GM announced its second executive shuffle in three months. It appears as though GM is falling into the same trap as Toyota did when it shifted it’s priority from safety and customer satisfaction to surpassing its rival in sales. As Toyota and others (Merck, Motorola, HP) have shown, doing so can lead to their downfall.

♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦ LEADERSHIP CATALYST TIPS ♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦

Don’t focus on getting bigger at the expense of getting better.

- Increasing scale should not be seen as the end goal, but rather as an outcome of pursuing your core purpose.

- Great leaders pursue growth in performance, distinctive difference, creativity and people, knowing sales growth will follow.

- Focusing on a noble core purpose and growth in this way will engage the hearts and minds of your people in a way that financial BHAGs never will.

♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦

Read More >>