Leadership Catalyst Blog

Jay Cutler of the Chicago Bears created a lot of controversy last week when a knee injury prevented him from finishing the NFC conference championship game against the Green Bay Packers. Many questioned his toughness, and believed he had “quit on his team” during their most important game of the year.

An MRI later showed the injury was indeed serious, and confirmed the decision for him not to play. It did not, however, excuse the lack of leadership and poor attitude he displayed during the remainder of the game. Instead of cheering on his teammates or supporting the backup quarterbacks, cameras repeatedly caught him sulking on the sidelines, listening to his iPod.

The lesson for CEOs is that, like Jay Cutler, we are always “on camera” in our organizations. We need to periodically check ourselves to make sure we haven’t succumbed to bad leadership habits and make sure that we aren’t displaying a poor attitude, which can be contagious for the rest of our organization.

Mike Myatt makes a compelling case that attitude reflects leadership and is a decision.

“Show me a CEO with a bad attitude and I’ll show you a poor leader. While this sounds simple enough at face value, I have consistently found that one of the most often overlooked leadership attributes is that of a positive attitude. As a CEO, how can you expect to inspire, motivate, engender confidence, and to lead with a lousy attitude? The simple answer is that you can’t…it just won’t work. CEOs with bad attitudes will not only fail to engage their workforce, but they will quickly find themselves shown the door as their attitude’s impact on performance becomes visible to the board.”

Do you need an attitude adjustment? Click here for a 5 point checklist to check yourself, and some compelling statistics about why you may want to change.

Read More >>Research backs claims that Vistage CEOs outperform their nonmember peers.

All Blog Posts, Vistage Peer Groups / 31.10.20101 comments

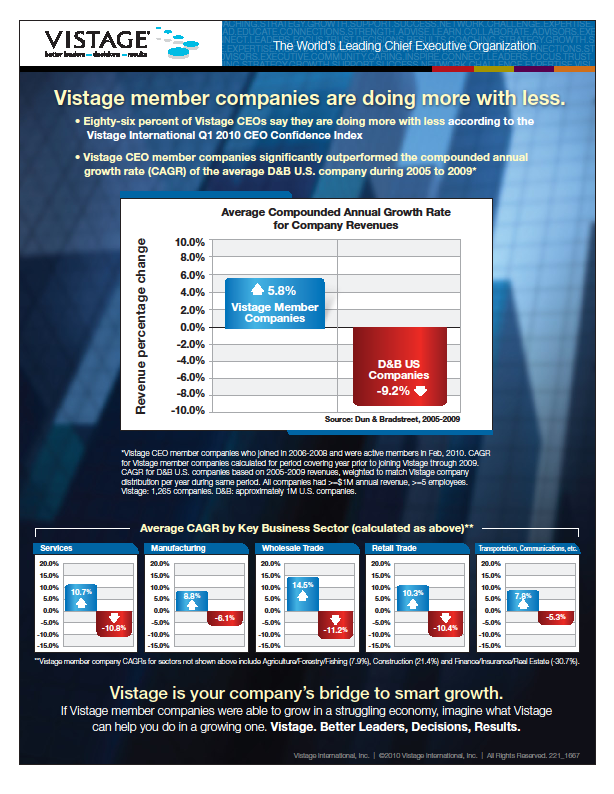

In last week’s post, I featured a CNBC broadcast regarding Vistage Member CEOs forecasting short term growth for small companies over the next two quarters. In that report was a caveat that Vistage CEOs may not be a totally representative sample of Small Business CEOs, because independent research shows that they consistently outperfom peer nonmember companies. I asked Vistage International to share their evidence, and was impressed with the research they produced. As can be seen from the graphs below, a Vistage Sample of 1265 member companies was compared with a statistically matched sample of about a million D & B nonmember companies. Over the period 2006 though 2009, Vistage companies outperformed nonmember companies on CAGR by15 percentage points. Moreover, this trend was consistent across all major business segments, ranging from a 13.2 percentage point difference in the Transportation and Communication Sector, to a 25.7 percentage point difference in the Wholesale Trade sector. In other words, in one of the toughest economies in history, Vistage member companies averaged 5.8 % revenue growth, while nonmembers averaged a (9.2%) revenue decline. In future posts, we will explore the factors that contribute to that sizeable performance difference.

Read More >>

CNBC reports that 67% of Vistage CEOs Predict Revenue Growth for their Companies

All Blog Posts, Vistage Peer Groups / 23.10.2010

Rafael Pastor appeared as a guest on CNBCon Monday afternoon wherein he released a new economic survey of Vistage CEOs outlook on the economy. In this 5 minute CNBC video clip (Please endure the 20 second lead ad), Pastor relates that the Vistage CEOs surveyed (representing over 14,000 member companies worldwide, with 10,000 member companies in the USA) are experiencing a modest lift in this economy, and are forecasting growth two quarters out, and a better economic forecast in 2011 than the market specialists are forecasting. (Note: Vistage CEOs may not be a representative sample of small businesses because independent research shows that Vistage member companies consistently outperform their non-participating peers.) Despite not being a totally representative sample, the Vistage CEO Confidence Index is a reliable leading indicator of GPD growth two quarters out. Pastor goes on to say that Vistage member companies do not forecast significant job growth in 2011. Rather, Vistage CEOs are focused on doing more with less, focusing on international markets, technology productivity enhancements to reduce costs, and operating their companies more profitably with little intention of rehiring many of those that were laid off earlier in the recession.

Other interesting survey highlights include:

- 92% expect health care costs to go up

- 67% say their business will be hurt if the Bush tax cuts are not extended

- 62% expect Republicans to control the November elections

- 52% say they would not start a new business in the current economic climate

CEOs, like HIPPOs, at times need to avoid trampling others.

All Blog Posts, Vistage Peer Groups / 08.08.2010

Walking into my client’s building, I noticed a large crew of maintenance workers feverishly manicuring the company grounds. When I asked the new CEO what had prompted such frenzied activity, he shook his head and said that earlier that morning, he had commented to the receptionist that he was having a hard time keeping up with his lawn, with all of the rain they had been having. His comment had been misunderstood by a bystander as criticism of how the grounds were being maintained, and reinforcements had been dispatched to manage the “grounds keeping crisis”. This was my first introduction to the “HIPPO” effect, which is an acronym for how the Highest Paid Person’s Opinion can ripple through an organization.

The effect is even greater when a CEO has strong views about an issue. For example, Steve Jobs pushed through the introduction of the new iPhone, even though problems about the antenna design had been known for months.

Suzanne Lucas (a.k.a. Evil HR Lady) suggests 5 tips for how employees can avoid being trampled by a HIPPO. I think they are pretty good, and I recommend that CEO’s not only read them, but distribute them and discuss them at a team meeting to assure their opinions are being constructively challenged.

CEOs, like HIPPOs, at times need to avoid trampling others.

Read More >>What can CEOs learn from a twenty-something college dropout?

All Blog Posts, Vistage Peer Groups / 29.07.2010

I often talk to fellow CEOs about their development, and who they would like to have in a CEO peer group with them. Like most of us, they want someone who has already been down the road that they are traveling, and can point out the opportunities and landmines they may encounter on their journey. They typically think of someone who is more experienced (and older) than themselves who can challenge them and hold them accountable.

However, Joe Frontiera wrote an article in this week’s Washington Post entitled “Facebook’s leadership: Dissecting Mark Zuckerberg “ that challenges this notion that lessons must be learned from someone more experienced. In this one page article, he identifies lessons that can be learned from this 26 year old’s brief tenure as the co-founder and CEO of face book. Given Facebook has been estimated to be worth as much as $35B, these are lessons worth heeding. The one page article is worth a 5 minute read to learn more about the lessons highlighted below.

♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦ LEADERSHIP CATALYST TIPS ♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦

The key lessons learned in observing a 26 year old, highlighted by Frontiera are:

- “Believe in the vision.”

- “Execution can trump innovation.”

- “Mistakes become mistakes when you let them.”

- “The Devil is in the details.”

- “Ownership matters.”

♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦

Read More >>