Leadership Catalyst Blog

How to Increase Accountability

All Blog Posts, Coaching, Performance Management, Vistage Peer Groups / 22.11.20111 comments

In a recent Vistage meeting, a theme that emerged was how to better hold others accountable. People often agree in meetings to things with “their fingers crossed”, and don’t deliver on commitments. While this is the subject of many books and training programs, one quick fix is to assure that you have a “Level 5” agreement.

James Newton, CEO of Newton Learning corporation and longtime Vistage Speaker, outlines 5 levels of agreement. Below is a brief description of each agreement level, illustrated by a simple example of setting up a golf game. As you read the scenarios, consider the level of agreement you have achieved in those instances where people have not delivered on commitments.

Level 1 Agreement: No agreement at all.

Brian: “Hey Mike, what do you say we play golf after our next meeting.”

Mike: “There’s an idea.”

Level 2 Agreement: Likes the idea, but no agreement.

Brian: “Hey Mike, let’s play golf after our next meeting.”

Mike: “Good idea!”

Level 3 Agreement: Reluctant agreement–but no commitment to do anything.

Brian: “Mike, Let’s play golf after our next meeting.”

Mike: “Man, I am really swamped, I better not.”

Brian: “Come on Mike, this will probably be our last chance before snowfall.”

Mike: “OK, I’m in.”

Level 4 Agreement: Enthusiastic agreement–but no commitment to do anything.

Brian: “Mike, let’s play golf after our next meeting”

Mike: “Great idea! Count me in.”

Level 5 Agreement: Specific commitment of who is going to do what by when, stated by the accountable person.

Brian: “Mike, let’s play golf after our next meeting”

Mike: “Great idea!” I’m in.”

Brian: “Where do you want to play.”

Mike: “Let’s play at my club. I’ll make a tee time for after our meeting.”

Brian: “How about if we have our meeting at your club so we can tee off right after that.”

Mike: “Great, I’ll meet you at my club for our monthly one-to-one on Friday at 2:00 pm and make a tee time for 3:30 pm.”

♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦ LEADERSHIP CATALYST TIP ♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦

Accountability increases with the level of agreement. If you are having trouble holding people accountable, push for a Level 5 Agreement, with a specific commitment to what is going to get done, by whom, and by when that is stated by the accountable person. It may take a little longer, but it will increase accountability and execution–and will save you a lot of time in the long run.

♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦♦

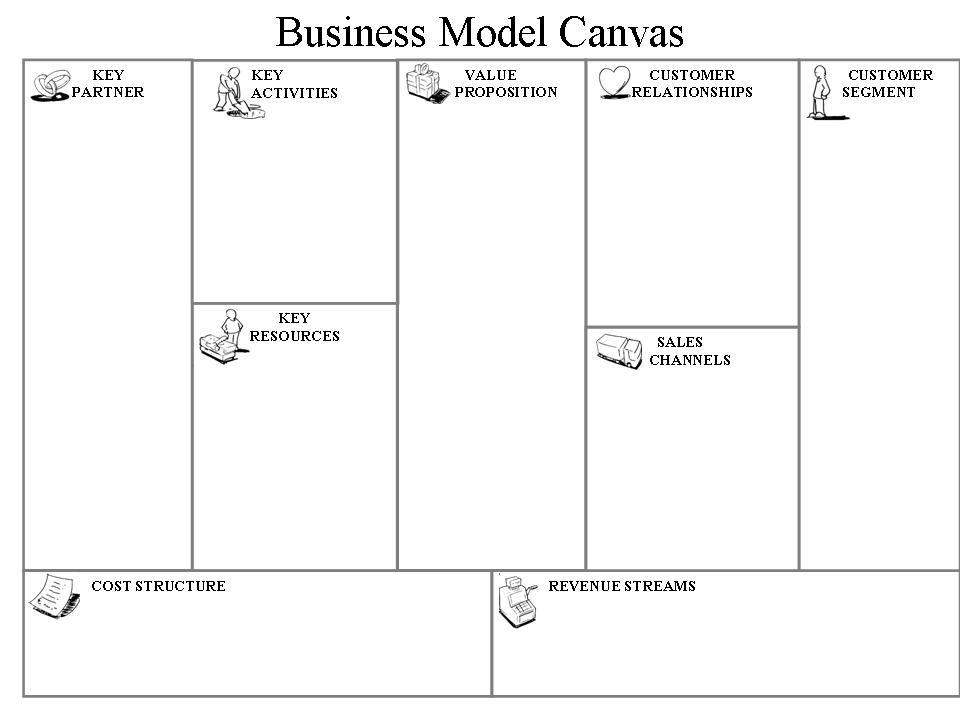

Is your business model dying? How do you know?

All Blog Posts, Business, Strategy, Vistage Peer Groups / 30.10.2011

- Why did XEROX give the mouse and “windows” technology to APPLE?

- Why didn’t AT&T invent SKYPE?

- Why didn’t MICROSOFT invent GOOGLE?

- Why didn’t BLOCKBUSTER invent NETFLIX?

- What changes have you made to your business model in the last couple of years?

- If an employee came to you with a “game changing” idea that might threaten your core business in the short term, would you listen to them?

- Is your business model dying, how do you know?

A Death in Cupertino | The Right Kind of Tyrant

All Blog Posts, Motivation, Vistage Peer Groups / 11.10.2011

“ Remembering that I’ll be dead soon is the most important tool I’ve ever encountered to help me make the big choices in life; because almost everything —all external expectations, all pride, all fear of embarrassment or failure — these things just fall away in the face of death, leaving only what is truly important. Remembering that you are going to die is the best way I know to avoid the trap of thinking you have something to lose.

You are already naked. There is no reason not to follow your heart.”

Steve Jobs

1955-2011

Founder and CEO of Apple

From his Stanford University Commencement Address, 2005

Picking an article to share with you about the passing of Steve Jobs is an impossible task with so many that knew him sharing their impressions on one of the most important entrepreneurs in history.

We have a saying in Vistage: “We invite CEOs to our group but human beings show up.” To get a sense of what was important to this truly remarkable and essestial human being, I’d like to share with you the 15 minute video of his 2005 Stanford Commencement speech. I found it incredibly inspirational, and I hope you will share it with your friends, family and employees.

This inspiring speech, however, should not blind us to the fact that Steve Job’s management style was often very different from the warm, fuzzy and friendly feeling you get from using his products or visiting the Apple store at the mall. For some insights into the management style that made Apple the most valuable company in America, check out this article which suggests that if Steve Jobs was often a hard man to work for, he was, in fact, “The Right Kind of Tyrant.”

Thanks, Steve, for all you have given us. Rest in Peace

Numerous articles have been written about the resignation this past week of Steve Jobs as CEO of Apple (though he remains as chairman). I could list a dozen that I find compelling and you can easily find them online or elsewhere. It would be difficult to find one that does not celebrate his many successes. Fortunately, I found one that focuses on his many failures…and how they were indispensible to his breathtaking successes. Check out “Steve Jobs: America’s Greatest Failure” ; required reading for any entrepreneur….or those who manage one.

Read More >>Why I Admire CEOs of Small, Privately Held Companies

All Blog Posts, Vistage Peer Groups / 04.02.2011

Recently I attended a 30th anniversary celebration honoring 3 colleagues from my former company, PDI Ninth House. Like me, they had spent most of their careers working with Global 1000 firms all over the world. We shared memories of jet setting around the globe, working with top executives at major companies throughout the US, Asia, Europe, and the Middle East.

People were naturally curious about why, with all of my Global 1000 Company experience, I preferred to work with CEOs of small privately held companies. The short answer to that question is that I admire their courage and their total commitment to the success of their business and their people.

Jay Goltz expands upon this point in a New York Times article entitled “There are Two Kinds of CEOs” that appeared February 2, 2011. The article features a conversation between the writer and Rafael Pastor, the chairman and chief executive of Vistage, a leading organization of chief executives. They agreed that one of the biggest differences between CEOs of big public companies and CEOs who run small privately held companies is how connected the CEO is to the success of the business. While CEOs of both types of companies have significant upside consequences, the consequences of a business downturn are far more severe for the small private company CEO.

As Jay Goltz explains:

“When things get tough, instead of getting multimillion-dollar payouts to quit, many small-company C.E.O.’s are compelled to put even more money into the business. Mr. Pastor of Vistage recently polled the organization’s members on this question: “During this economic downturn, did you at any time pledge personal assets or invest personal money into your company to help weather the storm?” Forty-six percent said yes.

To many, betting the house may seem an insane risk to take. And maybe it is. But if small-business owners weren’t willing to take that risk, there would be far fewer small businesses in America. You see, many entrepreneurs are what I would call “all in”: all of their money, most of their time, and most of their ego and self worth and pride are involved. Sometimes they put too much in, at the expense of their families and general well-being.

But the fact is that when small company chief executives fail, they often face dire consequences. And that’s an aspect of business ownership that is rarely noted in the glamorized view of entrepreneurship that we frequently see portrayed. Nor is it fully understood by public officials who always seem eager to have small businesses borrow more aggressively and hire more aggressively.”

Read More >>Jay Cutler of the Chicago Bears created a lot of controversy last week when a knee injury prevented him from finishing the NFC conference championship game against the Green Bay Packers. Many questioned his toughness, and believed he had “quit on his team” during their most important game of the year.

An MRI later showed the injury was indeed serious, and confirmed the decision for him not to play. It did not, however, excuse the lack of leadership and poor attitude he displayed during the remainder of the game. Instead of cheering on his teammates or supporting the backup quarterbacks, cameras repeatedly caught him sulking on the sidelines, listening to his iPod.

The lesson for CEOs is that, like Jay Cutler, we are always “on camera” in our organizations. We need to periodically check ourselves to make sure we haven’t succumbed to bad leadership habits and make sure that we aren’t displaying a poor attitude, which can be contagious for the rest of our organization.

Mike Myatt makes a compelling case that attitude reflects leadership and is a decision.

“Show me a CEO with a bad attitude and I’ll show you a poor leader. While this sounds simple enough at face value, I have consistently found that one of the most often overlooked leadership attributes is that of a positive attitude. As a CEO, how can you expect to inspire, motivate, engender confidence, and to lead with a lousy attitude? The simple answer is that you can’t…it just won’t work. CEOs with bad attitudes will not only fail to engage their workforce, but they will quickly find themselves shown the door as their attitude’s impact on performance becomes visible to the board.”

Do you need an attitude adjustment? Click here for a 5 point checklist to check yourself, and some compelling statistics about why you may want to change.

Read More >>